Pakistan Rupee Falls Sharply Against US Dollar After Bad News from IMF

The Pakistani Rupee (PKR) reversed its momentum against the US Dollar (USD) and reported losses in the interbank market today. The local currency lost 42 paisas against the greenback at the close of the session today.

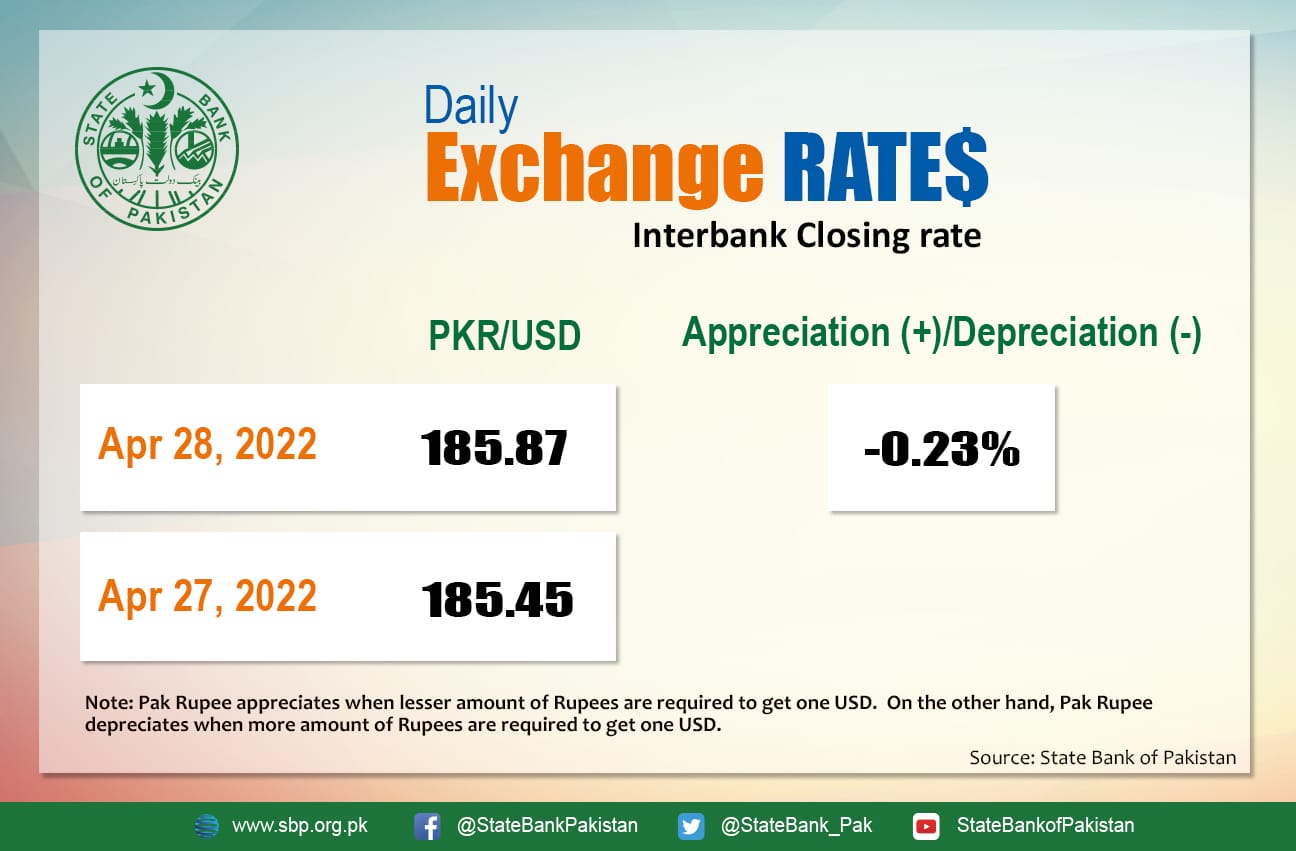

It depreciated by 0.23 percent against the USD and closed at Rs. 185.87 today after gaining 17 paisas and closing at Rs. 185.45 in the interbank market on Wednesday, 27 April. The domestic currency hit an intra-day high of Rs. 185.05 against the USD during today’s open market session.The rupee reversed gains against the dollar today after the International Monetary Fund (IMF) downgraded its growth rate forecast for Pakistan. According to the lender’s latest report “Regional Economic Outlook Middle East and Central Asia, divergent recoveries in turbulent times”, Pakistan’s GDP growth is projected to moderate from 5.6 percent in 2021 to 4 percent in 2022, and 4.2 percent in 2023.

Moreover, the IMF has projected consumer price inflation at 11.2 percent for 2022, up from 8.9 percent in 2021. Core consumer price inflation is projected at 8.5 percent for 2022 and 10 percent for 2023 against 6.6 percent in 2021. In a few, domestic supply-chain constraints (Armenia, Kyrgyz Republic) and stronger domestic demand (some CCA countries, Pakistan) have added to inflation pressures, the Fund added.

Globally, oil prices held on to stay above the $100 range but were trading in and out of the positive territory as merchants weighed up tightening Russian supplies and the prospect of dwindling demand in China. At the time of filing this report, Brent crude futures stayed above $105 a barrel, while the US West Texas Intermediate (WTI) crude futures sat comfortably at 102.3 a barrel.

Discussing the local currency’s performance earlier during the day, the former Treasury Head of Chase Manhattan Bank, Asad Rizvi tweeted that the undervalued PKR has continued to gain strength by inching up versus the USD. The rising Rupee has nothing to do with optimism about the economy.; it is rather due to reduced political uncertainty.

The imports are still costlier and the economy is solely dependent on foreign borrowing, he lamented.

Comments

Post a Comment